Washington, D.C. just got unexpectedly rocked. This could change everything.

And a bomb just got sent to the White House that has the entire Biden admin spooked.

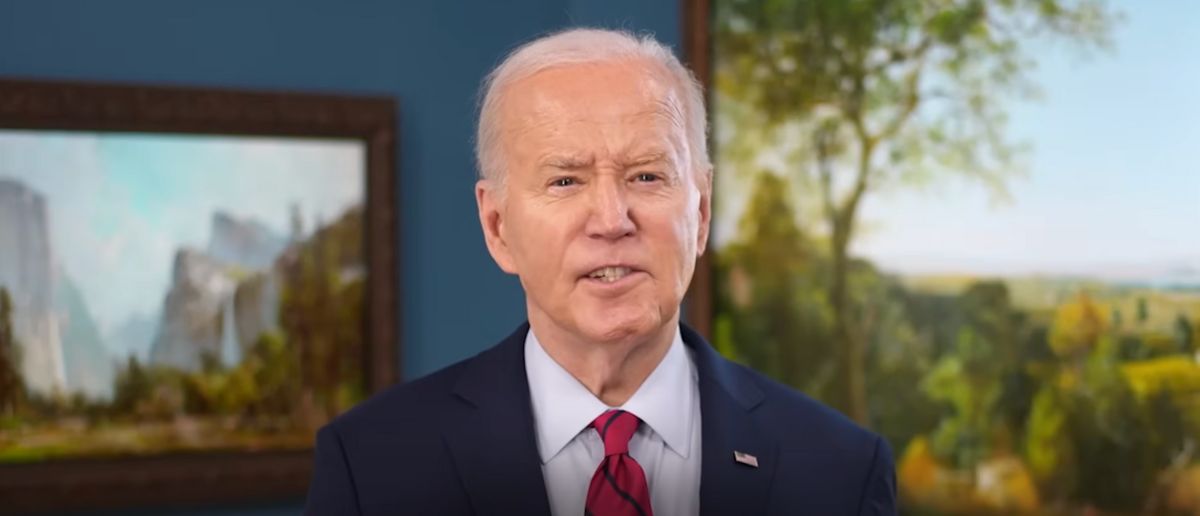

President Biden in recent weeks has been making the rounds claiming that the American economy is extremely strong and is actually the “strongest in the world,” which is only telling half the story.

America has had the strongest economy in the world ever since World War II. The vast, vast majority of the richest 100 companies in the world are American, after all. So, in that respect, America certainly is the healthiest economy in the world. Everyone else is still reliant on the United States and its leading market in a number of industries.

On the other hand, many middle class families and low-income families in the nation are feeling extremely left behind these days when it comes to the economy. They feel as though the economy isn’t working for them. They aren’t wrong.

Inflation has completely ravaged savings accounts and families pay anywhere between 50% to 100% more today for basic necessities like groceries than they were just a few short years ago before Joe Biden took office.

President Biden has also been claiming that inflation is under control and largely as a result of his own administration’s efforts. If you feel like inflation isn’t under control at all, you’d be right. The latest bombshell news to hit the White House has completely contradicted the claims of President Biden.

Inflation showed a slight decrease year-over-year in April but remains significantly high, continuing to impact the finances of average Americans, according to the latest Bureau of Labor Statistics (BLS) report released on Tuesday.

The consumer price index (CPI), which measures the prices of everyday goods, increased by 3.4% annually in April and 0.3% month-over-month, compared to 3.5% in March, according to the BLS. The core CPI, excluding the volatile categories of energy and food, rose by 3.6% year-over-year in April, down from 3.8% in February.

Average hourly earnings adjusted for inflation fell by 0.2% from March to April and 0.4% when factoring in the number of hours worked, according to the BLS. For the year ending in April, real average earnings saw a modest increase of just 0.5%.

Inflation peaked at 9% in June 2022 under President Joe Biden, rising from 1.4% year-over-year in January 2021, and has not dropped below 3% since.

The producer price index (PPI) for final demand, which tracks wholesale inflation before it reaches consumers, increased by 0.5% in April, amounting to a 2.2% year-over-year rise. This increase in the PPI suggests that more inflationary pressure may affect consumers, potentially leading to higher prices.

August came early to DC today: it's hot and sticky inflation in producer prices w/ PPI up 0.5% M/M for Apr and 2.2% Y/Y – that's the fastest annual increase since Apr '23…

…inflation is NOT dead; it's getting worse: pic.twitter.com/QXsIjmWfNO— E.J. Antoni, Ph.D. (@RealEJAntoni) May 14, 2024

To combat inflation, the Federal Reserve has set the federal funds rate between 5.25% and 5.50%, the highest level in 23 years. Most investors do not expect a rate cut before the Fed’s September meeting, as inflation remains high, according to the CME Group’s FedWatch Tool.

Gross domestic product (GDP) growth slowed to 1.6% in the first quarter of 2024, raising concerns about a period of stagflation characterized by low economic growth and high inflation.

The labor market also slowed in April, with only 175,000 new jobs added, compared to 303,000 in the previous month. The Conference Board predicts that labor market growth will decelerate further in the second half of 2024.

High inflation is increasingly affecting Biden’s prospects for the presidential election, with about 49% of voters surveyed by the Financial Times and the University of Michigan’s Ross School of Business believing that the president’s policies have harmed the economy. Additionally, around 80% of those surveyed cited inflation as one of their top three financial concerns.

In recent months, Biden has attributed inflation to corporate price markups during economic fluctuations, suggesting corporate greed as a factor. However, research from the Federal Reserve Bank of San Francisco refutes this, indicating that corporate markups during the recent inflation surge are consistent with those in other periods of economic recovery.

Most economy experts and theorists are quick to point to the Joe Biden administration’s extremely high spending habits as a core factor for why inflation continues to remain well-above standard levels.

Stay tuned to the DC Daily Journal.