The Left is grasping at straws. They don’t know what angle to attack President Trump from.

And now a Democrat Governor made an outrageous claim that is utterly humiliating.

North Carolina’s clean energy sector is at a crossroads, with significant economic implications tied to the potential repeal of the Inflation Reduction Act of 2022.

Economic Stakes in North Carolina’s Clean Energy Boom

North Carolina has carved out a strong position in the clean energy landscape, but the $891 billion Inflation Reduction Act’s future hangs in the balance.

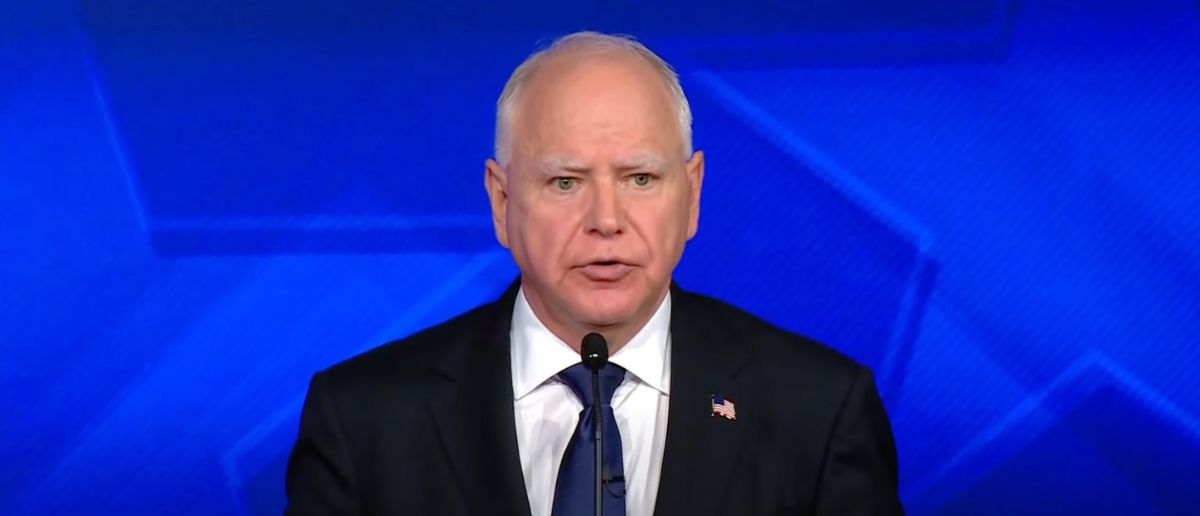

Governor Josh Stein, speaking at the annual Emerging Issues Forum at N.C. State University in Raleigh, warned that repealing the act could cost North Carolina “tens of thousands of jobs by 2030.”

He highlighted the state’s current standing, noting, “North Carolina is a leader in the clean energy economy, and we are home to more than 20,000 clean energy jobs and $24 billion in clean energy investments.”

Stein’s pitch is clear: the act’s tax credits have fueled this growth, and he urges Congress to preserve them, claiming, “Our state is well-positioned to continue that success, and I urge Congress to protect the clean energy investments that have contributed to our state’s prosperity.”

Yet, the economic picture suggests these benefits come with a steep price tag, raising questions about whether the act’s costs outweigh its gains.

Scrutinizing the Inflation Reduction Act’s Pricey Promises

The Tax Foundation, a nonpartisan group focused on tax policies that drive economic growth, has raised red flags about the Inflation Reduction Act’s escalating costs. Their analysis shows the act’s tax breaks are “more expensive than originally forecast,” casting doubt on its fiscal sustainability.

U.S. House Speaker Mike Johnson, R-La., described the needed reform as “somewhere between a scalpel and a sledgehammer,” signaling a push for precision in addressing the act’s inefficiencies.

The Tax Foundation’s stance is pragmatic: “Transcribed, it’s elimination of policies not working and tweaks to those that do work.”

This perspective challenges Stein’s blanket defense of the act, suggesting that a more targeted approach—trimming bloated subsidies while preserving effective incentives—could better serve economic growth without burdening taxpayers.

Local Gains vs. National Costs: A Case Study in Greenville

Greenville’s recent addition to the clean energy map highlights both the act’s local impact and its broader complexities.

In April, Boviet Solar opened the first phase of a $294 million factory, boasting a 2-gigawatt annual photovoltaic module output capacity, with phase two slated for next year. Backed by $34.6 million in state and local incentives over 12 years, the project is projected to create 900 jobs.

However, Stein’s claim that repeal would cost “billions in clean energy investments spurred by clean energy and manufacturing tax credits” and raise household electricity costs by $200 annually invites scrutiny. Critics argue that such projections overstate the act’s necessity, given that private investment and market-driven innovation could sustain clean energy growth without heavy federal subsidies.

North Carolina’s congressional delegation—10 Republicans and four Democrats—faces a tough choice: retain the act’s tax credits or pivot to a leaner, more cost-effective strategy.