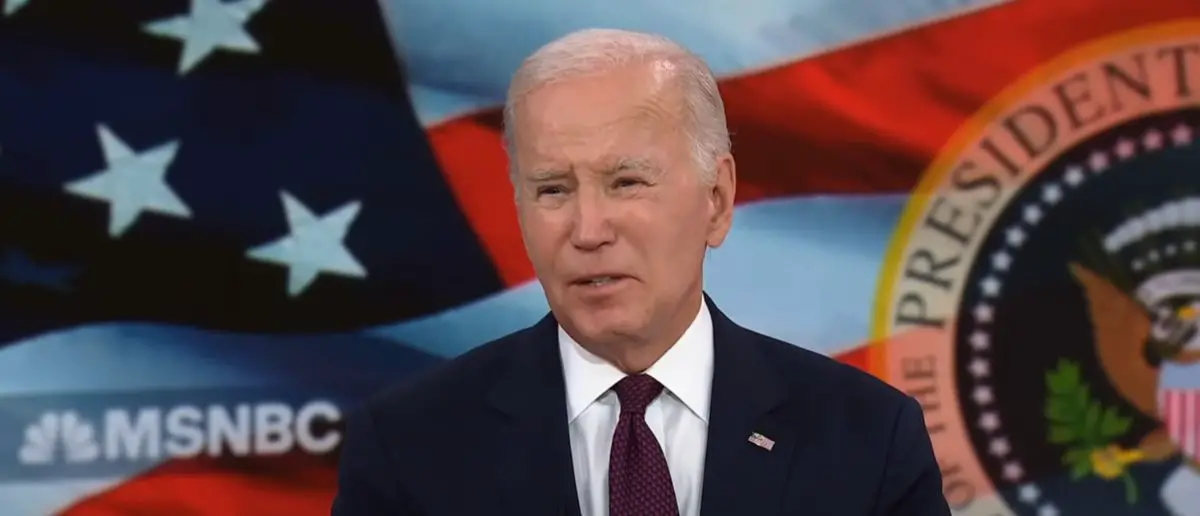

The White House has made a major mistake. There’s no taking it back.

Because Washington, D.C. has flooded and President Biden has no idea what to do.

Reuters reports that in response to the Biden administration’s plans to impose additional rules on the banking sector, the industry has sent more lobbyists to Washington, D.C. than at any time since the 2007 global financial crisis.

Lobbyists are now flooding the Washington, D.C. area right before the presidential election season in which Joe Biden is facing an uphill battle.

Reuters studied data from OpenSecrets and found that in 2023, a total of 486 federal lobbyists were dispatched to the Capitol by seven trade groups and banks with assets over $50 billion. This is a 3.4% increase from 2022, when the numbers also increased.

Regulators have lately proposed cracking down on fair lending abuses, transaction fees, capital requirement rises, and reforms connected to the crisis that shook the industry in early 2023. Affected overall income for the industry might be a result of these crackdowns.

There was a record-breaking 11% rise from 2022 to 2023, with 255 lobbyists dispatched by non-top eight banks with assets above $100 billion.

Three of the four biggest banks in the U.S. posted enormous profits for 2023, coinciding with the growth from smaller banks. In contrast, many small and medium-sized banks in the U.S. struggle with issues including high interest rates.

There’s growing concerns that the regulations being suggested by the Biden administration and his fellow Democrats ultimately just help big banks and disproportionately hurt small and medium-sized financial institutions.

Reuters reports that in the second half of 2023, banks engaged in a significant lobbying campaign to halt the planned capital rises in the Basel III endgame proposal. International changes prompted by the global financial crisis are the basis of the Basel III final regulations, which were considered in December by the Senate Banking Oversight Committee.

According to the Associated Press, regulators under Biden’s watch are now better able to monitor what the government views as unfair lending practices by financial services, thanks to the rescinding of measures from the Trump administration. The “junk fees” that the Biden administration claims are exploitative because they obscure the true cost, have also come under fire.

According to Investopedia, bank lobbying efforts surged from 2007 to 2009 in the wake of the global financial crisis. Their goal was to influence the terms of the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010, which aimed to reduce financial system risk through the introduction of new banking regulations. The Consumer Financial Protection Bureau (CFPB) was established by the law to safeguard customers against deceptive banking practices.

The Atlantic reports those who are against the Dodd-Frank banking industry’s lobbying efforts highlight the bill’s weak provisions, such as the fact that the Consumer Financial Protection Bureau (CFPB) will not be responsible for overseeing auto loans, the bill’s silence on the subject of government-sponsored enterprises Fannie Mae and Freddie Mac, and the bill’s failure to adequately address the problem of banks becoming too large to fail.

After a spate of bank collapses in 2023 scared depositors away from smaller institutions and toward megabanks, where they felt their money would be safer, the present structure makes small and medium-sized banks very susceptible to failure. Bank runs started at Silicon Valley Bank and quickly extended to First Republic and Signature, all of which eventually failed and required bailouts from the FDIC.

Eye-popping new reporting from my colleague Douglas Gillison reveals the # of bank lobbyists in Washington has hit a post-GFC high. Nearly 500 lobbyists working for banks in 2023! https://t.co/4nyMeMtnHO

— Pete Schroeder (@peteschroeder) February 8, 2024

This timing couldn’t be worse for Joe Biden and his reelection campaign.

A number of surveys suggest that if the presidential election were held today in a rematch between Joe Biden and former President Donald Trump, Donald Trump would likely win both the electoral college and the popular vote.

Hundreds more lobbyists crawling all over Washington, D.C. is yet another headache that the Biden administration has to deal with at the worst time.

Add this on top of the Biden regime’s foreign policy miscommunication and failures and overall mistrust from the public in handling the American economy, and Democrats are certainly going to be panicking about Biden’s chances in November.

Stay tuned to the DC Daily Journal.