The Biden-Harris admin has been handed many losses in court. They just keep racking them up.

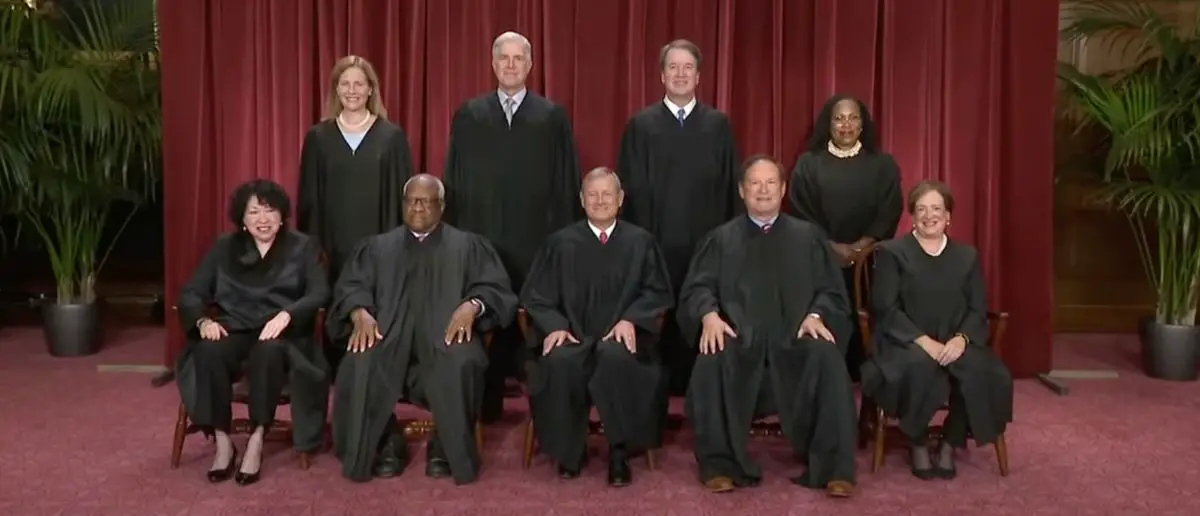

And now lawyers are stunned after the U.S. Supreme Court butchered the Biden-Harris regime.

The Biden administration’s efforts to forgive student loan debt continue to face legal challenges, with the Supreme Court recently refusing to lift an appeals court’s order blocking the latest forgiveness program. This decision follows a 2023 Supreme Court ruling that struck down a previous student debt forgiveness proposal from President Joe Biden.

Jonathan Turley, a law professor at George Washington University, commented on the situation during an appearance on The Story. When asked about a statement from Vice President Kamala Harris and the White House, Turley highlighted the administration’s persistent attempts to find legal justification for debt forgiveness.

“That’s the problem, that’s why they had to come up with a new way of doing this. The Supreme Court previously struck down efforts under the Heroes Act to forgive hundreds of billions of dollars and basically said you need to go to Congress,” Turley explained.

He emphasized the importance of following democratic processes, stating, “We have a system where before you give away billions of dollars, you really should go to Congress and ask them.” Turley expressed concern about the mounting national debt and criticized the administration’s approach to debt forgiveness.

'I Don't Know What They Will Do': Jonathan Turley Reacts To Supreme Court Halting Latest Biden Loan Forgiveness Effort pic.twitter.com/xyTS801avH

— Daily Caller (@DailyCaller) August 29, 2024

The Biden administration’s original plan, announced in August 2022, proposed forgiving $10,000 in student debt for those earning up to $125,000 annually, with Pell Grant recipients eligible for up to $20,000 in forgiveness. However, this plan was met with legal challenges and ultimately struck down by the Supreme Court.

Turley pointed out the administration’s reluctance to seek congressional approval, saying, “What’s happened here is after a stinging defeat in front of the Supreme Court saying you are circumventing the Constitution – an unconstitutional effort to give away hundreds of billions of dollars, instead of going to Congress and saying okay let’s have the vote they came up with another statute”.

The law professor expressed uncertainty about the administration’s next move if their current approach under the NEA (National Education Association) fails. He speculated, “Maybe they’re going to say it falls under FEMA’s hurricane fund. They seem to be willing to do any type of argument, except an argument to Congress, to ask representatives of the people, ‘Do you want to write off hundreds of billions of dollars in debt?'”

As the Biden administration continues to pursue student loan forgiveness, the legal and political landscape remains complex, with ongoing debates about the proper channels for implementing such significant financial policies.

The controversy surrounding student loan forgiveness has intensified following President Joe Biden’s attempts to implement widespread debt relief. Critics argue that the administration’s efforts are misguided, unfair, and potentially harmful to the economy.

Opponents of student loan forgiveness contend that it is fundamentally unfair to those who have already paid off their loans or chose not to attend college. They argue that forgiving student debt effectively penalizes responsible borrowers and taxpayers who never took on such obligations.

This sentiment was echoed by Senate Minority Leader Mitch McConnell, who called the idea “a slap in the face to every family who sacrificed to save for college, every graduate who paid their debt, and every American who chose a certain career path or volunteered to serve in our Armed Forces in order to avoid taking on debt.”

Furthermore, critics argue that loan forgiveness disproportionately benefits higher-income individuals. While the Biden administration has attempted to target relief towards lower-income borrowers, opponents point out that even with income caps, the policy still aids individuals making up to $125,000 annually or couples earning $250,000. This has led to concerns that the program is essentially subsidizing education for those who may not need financial assistance.

Roseanne gets extremely mad at Simone Biles.Who's is worth 14 million dollars but still took $44000 in student loan forgiveness.Why are we giving taxpayer funds to millionaires? I'm shocked more everyday. By the type of people who received student loan forgiveness. pic.twitter.com/ZvcfYkBLa5

— Charlotte Meyers (@Cyaindasun) August 22, 2024

Economic concerns also play a significant role in the opposition to student loan forgiveness. Some economists, including Jason Furman, President Barack Obama’s chief economist, have warned that debt cancellation could exacerbate inflation. They argue that by freeing up disposable income for millions of Americans, loan forgiveness could lead to increased consumer spending, potentially driving up prices across the economy.

Critics also contend that loan forgiveness fails to address the root causes of the student debt crisis, such as the rising cost of higher education. Marc Goldwein, senior policy director at the Committee for a Responsible Federal Budget, suggests that debt cancellation might actually worsen the problem by encouraging future students to take on more debt, expecting it to be forgiven later. This could lead to even higher tuition costs as colleges face less pressure to control expenses.

There’s also the idea that instead of broad loan forgiveness, policymakers should focus on reforming the higher education system to make it more affordable and accessible. These voices advocate for solutions that address the systemic issues causing the debt crisis, rather than what they view as a short-term fix that could have long-lasting negative consequences.

Stay tuned to the DC Daily Journal.